On October 11 Nasdaq shares of Yandex N.V., the parent company of Russian flagship internet company Yandex, suffered a 16% drop equal to $1.5 billion loss of capitalization. The Nasdaq linked the fall with the news of the amendments of the Information, Information Technology and Information Protection Law (Information Law).

As a means of background information, at the end of July 2019, a member of the Information Policy, IT and Communications Committee, Anton Gorelkin, brought in an initiative of amendments. The draft proposes to include in the text of the Information Law new subjects such as the Significant Information Resource (SIR). The area which may have caused the October drop is related to the 20% limitation of the foreign ownership in SIRs. Let’s take a closer look at the proposed amendments.

What does a Significant Information Resource mean?

The text of the amendments provides four subjects that could be defined as a SIR, namely:

- Website;

- Site page;

- Information system; and (or)

- Computer programs.

To be acknowledged as a SIR, the above mentioned information resources must (1) Collect information about users located in the territory of the Russian Federation and (2) be recognized as significant for the development of the Russian information and communication infrastructure, and data processing technologies by result of specific procedures prescribed by the law.

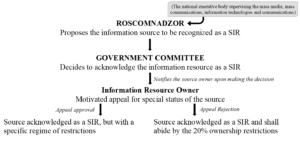

What is the procedure for the recognition of resources as a SIR?

The procedure for the recognition as a SIR may include the following:

What are the potential consequences for the information source to be recognized as a SIR?

The draft prescribes for a 20% limitation of foreign capital in the SIR which shall be fulfilled by the company within 2 months after the notification of the recognition of, for example, its website as a SIR.

In case of violation of the limitations proposed, a ban will be imposed on the use of the SIR for advertisements aimed at Russian consumers. Additionally, as the shares of the foreign owner would be deemed as illegally owned, the portion exceeding 20% cannot be considered during the company decision making process.

However, the current draft version is highly applicable to the ordinary shares structure where the holders of ordinary shares are typically entitled to one vote per share. The companies with an AB shares structure, A class shares with controlling rights and B class shares without controlling rights, in a case in which a foreign owner has the controlling A class shares which are less than 20% of the overall company shares, the limitations will be considered to be in accordance with the limitations.

Conclusion

The new regulations could affect many Russian companies, besides the previously mentioned Yandex, the job search company HeadHunter, online marketplace retailer Ozon and tech giant Mail.Ru Group as well as the Russian business of AliExpress, which we have covered in our previous articles, may all suffer from the amendments. The silence in the definition in regards to the national nature of the SIR make it possible to also include a list foreign companies such as Google or Facebook into the mix.

Overall, the amendments have received negative feedback from experts as a potential barrier for foreign direct investments in the Russian IT sector. D’Andrea & Partners will keep you updated upon the status of the amendments. Do not hesitate to contact us in case you may have any inquiry for the regulation of investments in Russia.