Invest in Russia: An Overview of Special Economic Zones

Special economic zones (SEZ) in Russia are territories with a special legal status and economic benefits to in order to attract both Russian and foreign investors to priority sectors in the country. Primarily, the creation of SEZs was initiated for the purposes of the development of the high-tech sector, import-substituting industries, the tourism sector, and the development and production of new types of products, as well as the expansion of transportation and logistics systems. The creation and operation of SEZs was regulated by the Federal Law FZ-116 as of July 22nd , 2005.

There are currently four types of special economic zones in Russia[1]:

- Industrial Production SEZ: Created for the purpose of the production and processing of goods, as well as for their future sales. Industrial production SEZs are located in the most economically developed regions of Russia. They are characterized by the predominance of industrial enterprises, as well as the presence of an extensive transport infrastructure, abundant natural resources, and a skilled labor force.

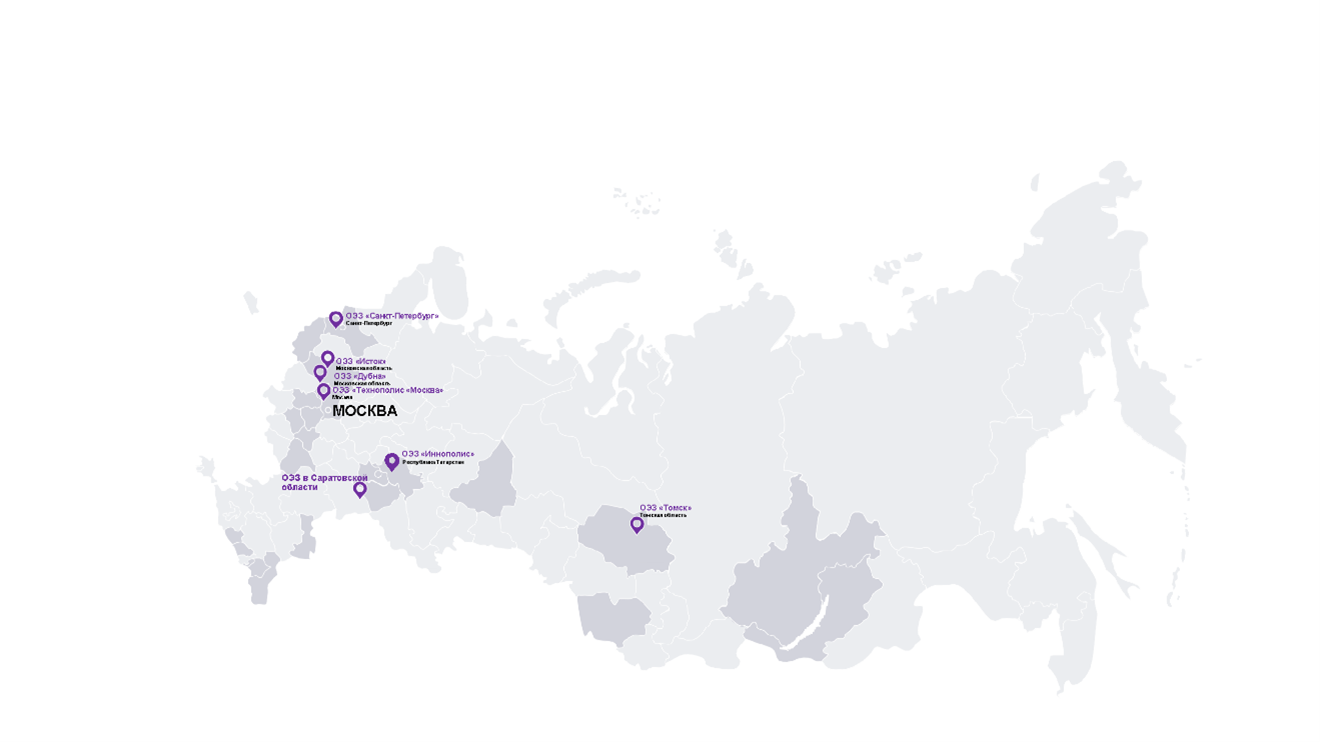

- Technology and Innovation SEZ: Formed in order to develop innovative activities for the creation and sale of scientific and technical products, bringing them to industrial use, including the manufacture, testing and sale of pilot batches, as well as the creation of software products and systems, processing and transmitting data, distributed computing systems and the provision of services for the implementation and maintenance of such products.

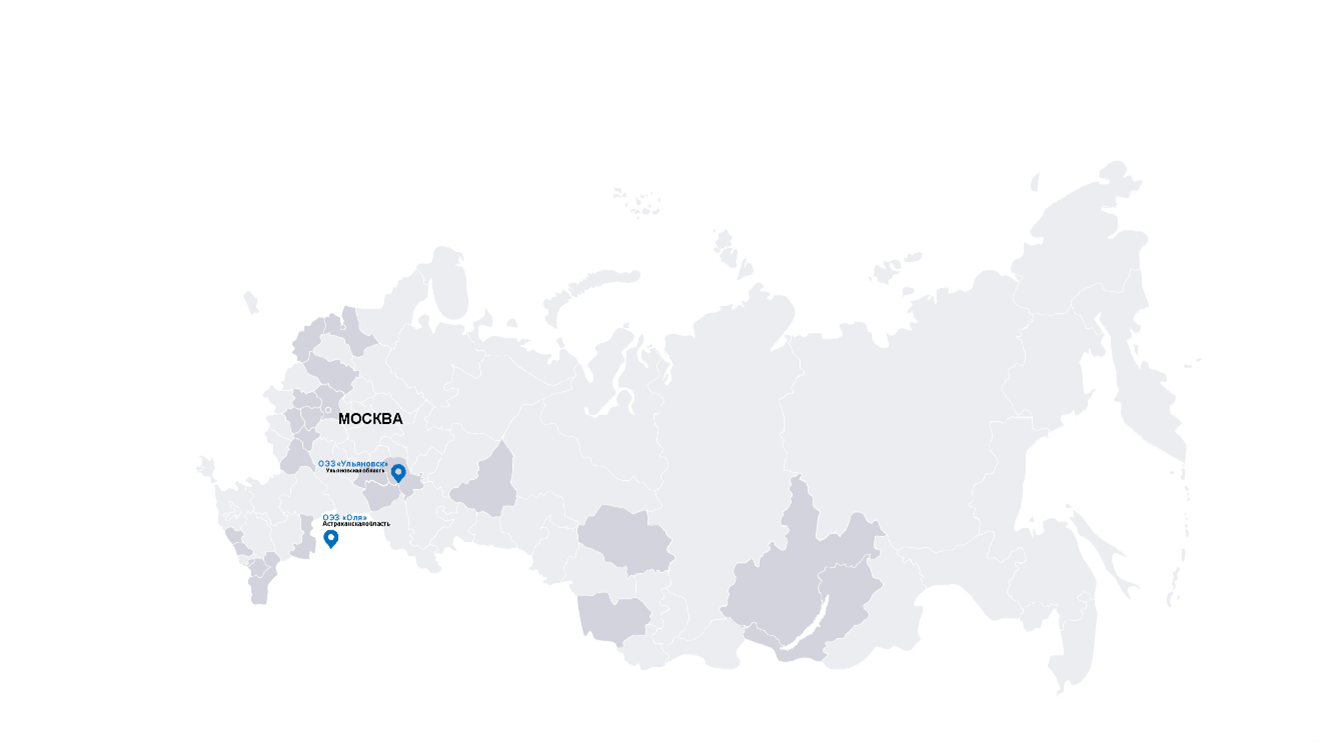

- Port Area SEZ: Set up in order to create a platform for organizing shipbuilding and ship repair activities, providing logistics services, as well as a base for new routes, located in the immediate vicinity of the main transportation routes. In such SEZs, it is normally permitted to carry out port activities, inclusive of the construction, and operation of infrastructure facilities of a seaport, river port or airport.

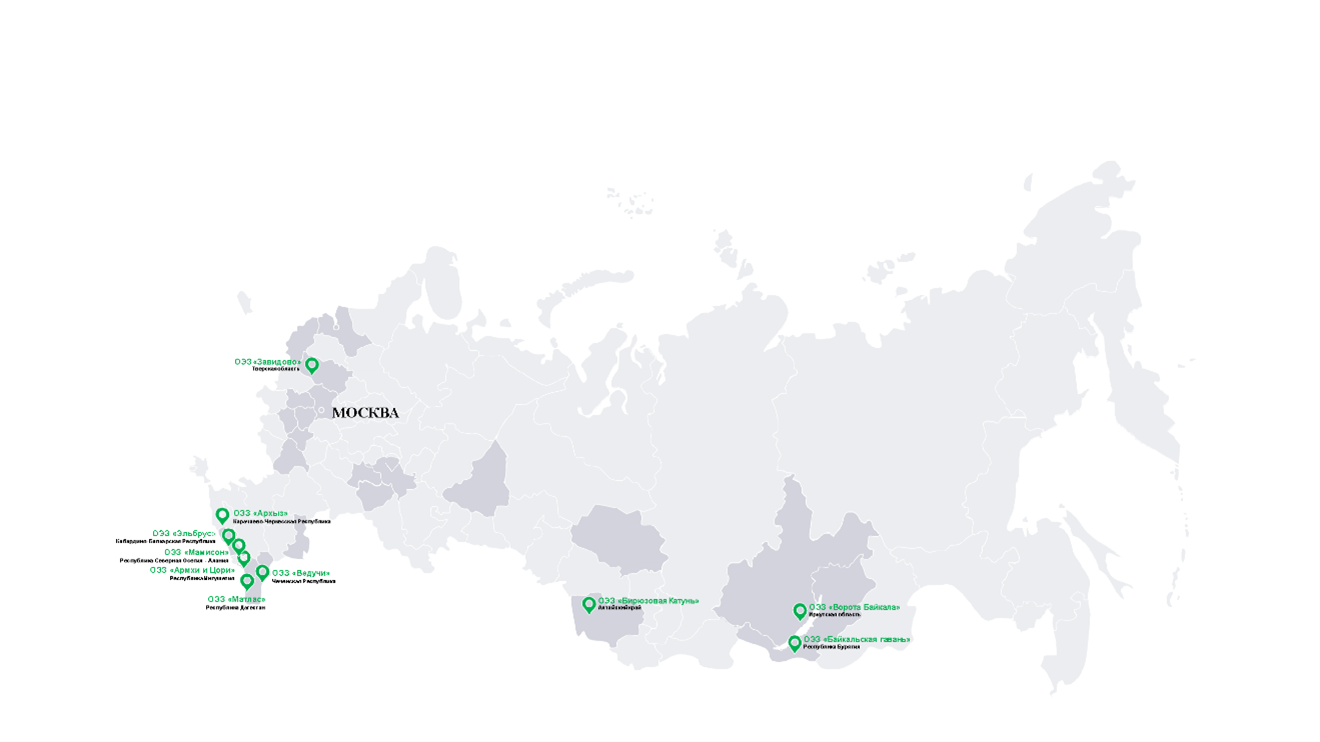

- Tourism and Recreational SEZ: Tourism and recreational activities are only permitted in such zones, namely, activities for the construction, reconstruction & operation of tourist industry facilities, facilities intended for the treatment of long-term illnesses, medical rehabilitation, and recreation, as well as tourist activities and activities for the development of mineral deposits.

Briefly examining the numbers, the following information is appropriate to highlight:

- There are 39 SEZs in Russia of which 20 are industrial production based, 7 are technology and innovation based, 10 are tourism and recreational based and 2 are port based zones respectively.

- Over the 15 years of SEZs, more than 900 residents have been registered, of which range from more than 140 companies with foreign capital from 42 countries.

- Over the years, the total volume of declared investments has amounted to more than 1.17 trillion rubles.

- More than 44 thousand jobs were created and about 194 billion rubles were paid in tax payments, customs deductions, and insurance premiums.

SEZs offer businesses a number of competitive advantages for the implementation of projects, including the localization of production in Russia and entry into the Eurasian market, including such measures as:

- Projects receive the infrastructure created at the expense of the state budget for business development, which allows for a reduction of production costs.

- Free customs zone regime, i.e. residents receive significant customs benefits.

- The authorities provide a number of tax preferential policies.

- The administrative procedures are simplified with the “one window” administration system to allow simplified interaction with state regulatory bodies.

In conclusion, SEZs in Russia are one of the most ambitious projects offering an array of business opportunities designed for both domestic and foreign investors in the Russian economy. Over the years they have been upgraded to offer the best business environment in terms of ease of transactions, preferential policies, simplified legal and customs procedures, as well as minimizing administrative burdens. Should you have any questions, or require any additional information, please do not hesitate to contact us at info@dandreapartners.com.

[1] Ministry of Economic Development of the Russian Federation https://www.economy.gov.ru/material/directions/regionalnoe_razvitie/instrumenty_razvitiya_territoriy/osobye_ekonomicheskie_zony/