The beginning of 2020 has already been marked by amendments to the Russian minimum wage standard, and even more draft laws are waiting for being discussed in 2020.

- Surge of the Minimum Wage Standard

On January 1, 2020, amendments to the Federal law Regulating Minimum Wage came into force, providing for an increase in the minimum wage by 7.5%, namely from RUB 11,280 per month (USD 183 per month) up to RUB 12,130 per month (USD 198 per month).

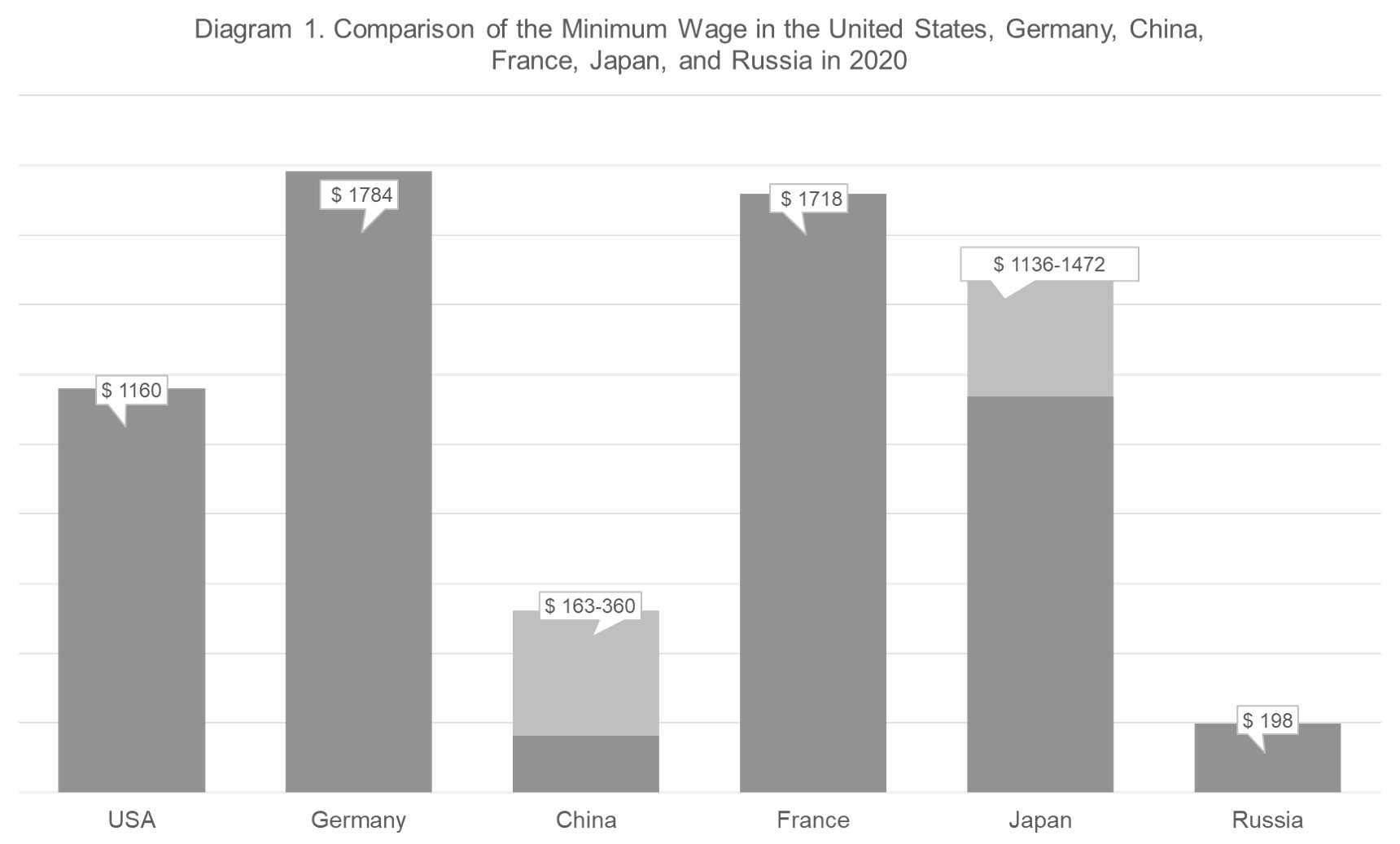

In comparison, even with the increase, the Russian minimum wage remains significantly lower than that of most countries engaging in foreign direct investment in Russia (see Diagram 1).

Note. The labor laws of China and Japan do not provide for a national minimum wage standard. In these countries, it is defined only by the local authority (of provinces, direct-controlled municipalities or prefectures).

The amendments also affect the way in which minimum wages are determined as currently it not only shall be equal but may also exceed the value of the subsistence minimum for the second quarter of the previous year.

In practice, in addition to the potential necessity of the employer to pay more for wages, an increase in the minimum wage may also affect the employer’s expenses under the payment of the following social benefits:

- Temporary disability security;

- Maternity benefits;

- Child care benefits.

In cases where the salary paid is below that of the minimum wage standard, the administrative law prescribes the following liabilities:

- A fine for persons engaged in business activities without forming a legal entity to the amount of RUB 1,000 – 5,000;

- A fine for legal entities between RUB 30,000 – 50 000;

- In addition to the previous point, the managing director of the legal entity may be disqualified for a period of 1 to 3 years by a court decision.

- Amendment of The Minimum Wage Composition

Along with the increase of the minimum wage standard , the lower house of the Federal Assembly of Russia is currently discussing a Draft Law No. 762526-7 that shall amend Art. 133 and 133.1 of the Russian Labor Code, excluding compensation payments from the minimum wage.

According to the Order of Federal Tax Bureau No. N ММ-7-5/114@ compensation payments include the following types of payments:

- To employees engaged in heavy work, work with harmful, dangerous and other special working conditions;

- To employees engaged in work in areas with special climate conditions (for example, due to the cold climate – Irkutsk region, Novosibirsk region);

- To employees engaged in working in conditions that deviate from normal conditions (for example, overtime work, night work, joint employment, expanding of official duties, working during weekends and non-working holidays).

At the same time, according to the Decisions of the Russian Constitutional Court No. 38-P dated by 07.12.2017 and No. 17-P dated by 11.04.2019, district coefficients and percentage allowances paid due to the engagement of an employee to work in areas with special climate conditions (the second item in the above list), as well as increased payment for overtime, night work, work during weekends and holidays (partially inclusive of the third item in the above list) are already excluded from the minimum wage.

Therefore, from a legal point of view, the proposed amendment targeted to expand the number of payments excluded from the minimum wage should ease the application of the law for employers. In practice, employers will be required to commence due diligence actions to conform with the basic salary fixed by the already concluded labor contracts and templates used within the company.

In conclusion, the aforementioned amendments are aimed at improving the protection of employees in Russia. While considering the labor market realities, the amendments will mainly affect the budget sector and the unskilled labor sector, which mostly rely on the minimum wage standard regulations. If you have any inquiries please do not hesitate to contact D’Andrea & Partners specialists via the following email address: russiadesk@dandreapartners.com.